Data, unless displayed in a way that’s consumable is about as useful as a riflescope with the lens caps glued shut. If you can’t see through it, what good is it?

The shooting sports industry is an ever-changing ebb and flow of trends. As a retailer, keeping up with those trends can be a headache. The National Association of Sporting Goods Wholesalers has been working over the past five years to relieve the pain by assembling the largest data sample anywhere in the industry about what is selling, and why.

NASGW’s SCOPE puts industry facts at your fingertips, providing a platform that lays out trends using real data, in real time and most importantly, in a way that’s easily understood.

The Goal

NASGW’s SCOPE programs are an industry-owned, distributor-led initiative to collect and analyze data that strengthens shooting sports businesses.

“Distributors have taken the lead to create information that helps our industry grow,” says NASGW President Kenyon Gleason. “Through SCOPE’s data tools, retailers can better rely on their distributor partners to understand market trends and what that means for their business.”

At this time, SCOPE data comes directly from 20 wholesalers of firearms, ammunition, optics and accessories. “About 65% of gun sales flow through this channel,” Gleason says. “It's the largest data sample anywhere in the industry.”

Once data is collected, NASGW analysts crunch the numbers and display it in a way that is easily understandable. Most importantly, the displayed information is completely factual.

“These are all facts,” says Tom Hopper, senior data analyst for NASGW. “They’re not extrapolated. There is no projecting of trends with this data. This is actually what’s happening.”

NASGW’s unique position sitting between manufacturers, distributors and retailers is why SCOPE works. Collecting and analyzing data from that standpoint creates unbiased results for any retailer to use.

“There are a lot of businesses involved in SCOPE,” Gleason says. “It’s not just an NASGW initiative. SCOPE is an industry-wide movement that benefits every business from manufacturer to dealer — these trusted partnerships make SCOPE possible.”

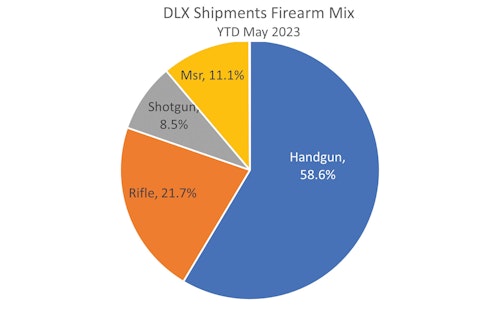

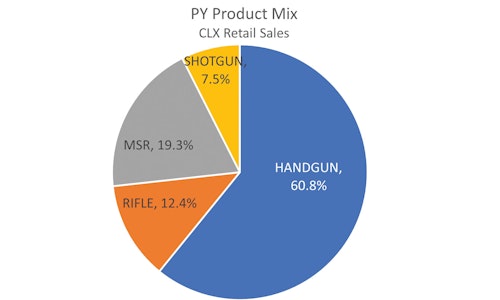

SCOPE covers a broad range of the industry. To sort and simplify, the software is broken down into categories that focus on specific areas of the market. SCOPE DLX handles the distribution data and SCOPE CLX covers the retail side.

SCOPE DLX

“SCOPE DLX is specifically for distribution,” Hopper says. “Because of that, it makes up the larger portion.”

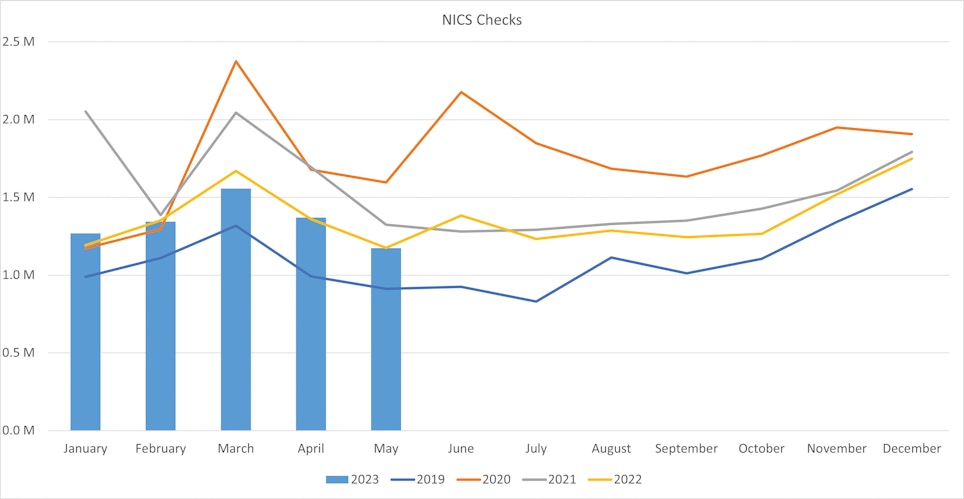

It’s an inventory and sales platform where sales inventory is received on a weekly basis and updated every Wednesday through the previous Saturday, providing real-time and accurate information.

Acquiring the current band of 20 partners didn’t happen overnight. It was years in the making getting wholesalers onboard, but now that it has taken root, the benefit to distributors is obvious.

“Now there’s a lot of trust and confidence,” Hopper says. “They understand what we’re doing and that it’s an industry initiative. We are a non-profit organization that’s trying to collect, standardize and analyze data.”

Not only does this provide critical information for improving manufacturers’ interest and ability to sell through distribution, it aids in educating policymakers on the value of shooting sports.

“The NSSF is using this data for government analytics and discussions,” Hopper says. “The trust is there.”

SCOPE CLX

The CLX side is a retail takeaway. It covers everything from month-to-month consumer insight, manufacturer and product-level analytics and price-point to average price trend analytics.

Currently, data from over 600 independent stores flow through four point-of-sale software providers to NASGW analysts. “Individual point-of-sale providers put cash registers in the FFL,” Hopper says. “They capture the sales and we aggregate that.”

Bringing the data in this way ensures real, accurate and timely data. It also pools information that would normally be impossible to put together, again the advantage of NASGW’s place within the industry. “These are independent cash register retail sales companies,” Hopper says. “They are competitors. As a non-profit we have the advantage of bringing these competitors under one umbrella, aggregating their data and feeding it to the marketplace in real-time snapshots.”

According to Hopper, the advantage to CLX is that it displays the consumer takeaway and DLX is showing how the FFL is buying back.

“Looking at the shotgun data in CLX, we can see the shotgun category is actually increasing year-over-year,” says Hopper. “But, we know they are not being bought back at the same rate because shotguns were down on the DLX side.”

Like DLX, SCOPE CLX software has the ability to break down retail information to sort by pricing, rifles, pistols, further organize firearms into subcategories and much more. It can show trends in the average unit retail price or break down the year-to-date market share of top manufacturers of a specific type of firearm.

“The category performance in CLX actually has out-the-door retail too,” Hopper says. “There’s a lot there, so people can see and understand how products are moving at a macro level.”

Looking ahead, retailers can expect to find SCOPE CLX integrated right into their point-of-sale software providers like Celerant, Coreware, Orchid POS and more to come. NASGW has the capability to integrate with any POS, so FFLs can contact their provider to get started.

SCOPE PLX

PLX is the master product catalog and data governance. It’s the software system connected to SCOPE’s master UPC list to manage data tagging.

“PLX is the system that brings everything in uniform,” Hopper says. “It gives credibility and insight to DLX and CLX, which are data feeds. PLX provides uniformity and gives everyone the same look at the same data. It’s a way to make sure that no matter how people enter data, it comes out uniform.”

For example, there are multiple ways people may enter 9mm in their system, such as .9mm, .9 mm, or 9mm. “Any time there is a space or something slightly different, it causes a separate line entry,” Hopper says. “PLX is the software for data standardization that combines those entries into one.”

PLX allows NASGW, along with input of additional stakeholders, to lead the creation of new standards and manage existing standards around data. “It’s the key to the insights of the data,” Hopper says. “Without that you can’t really aggregate it in any meaningful way.”

Combining it all

“SCOPE is really an organized approach to aggregating and streamlining the data and making sure people get the data back in a consumable form,” Hopper says.

Using DLX and CLX together is the best way to consume the data and truly understand market trends year-over-year or month-by-month, and Hopper assures that no matter what questions people may have, he’s there to help.

“We want to answer the question of what they need to be successful using the data,” Hopper says. “If people have questions about the data, where it comes from, how it's aggregated and all that, we can go technical and show them. If it’s a question on how to use the data, I’ll teach them how to do that too.”

Editor’s note: We’ll be working with NASGW to delve deeper into the data and analyze current industry trends in future issues of Shooting Sports Retailer.