The coronavirus is affecting the outdoor industry and Archery Trade Association (ATA)-member businesses. If your business (gun, bow or both) is suffering, consider applying for an Economic Injury Disaster Loan through the U.S. Small Business Administration (SBA).

The SBA’s Economic Injury Disaster Loan program provides small businesses in all U.S. states and territories with working capital loans of up to $2 million because of COVID-19. These loans provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing. Use the money to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact.

We spoke with Michael Lampton, a public affairs manager with the SBA, to learn more about the loan application process, as well as how ATA members would receive funding, or what they can do if they’re not approved. Let’s get started.

Who’s Eligible?

All small business owners in all U.S. states and territories are currently eligible to apply for a low-interest loan due to COVID-19.

If you’re wondering what constitutes a “small business,” the North American Industry Classification System classifies businesses within an industry using a six-digit code. Some businesses are considered small based on their revenue stream, while others are considered small based on the number of employees they have.

Regardless of your code classification, Mark Ihenacho, public affairs supervisor for the SBA, encourages businesses in distress to apply for the loan. He said the eligibility determinations are made at the time of processing, and a specialist in the processing center will review your application to ensure you’re using the correct code.

Ihenacho said most businesses that apply don’t have issues with the size parameter, but the parameter is set to ensure large companies don’t try to take advantage of the program.

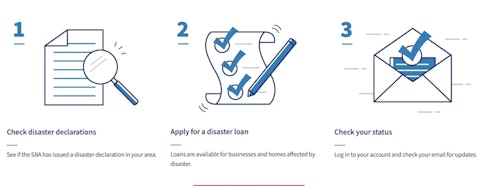

How do I apply?

Eligible businesses can apply in one of two ways:

1. Visit www.sba.gov/disaster. You’ll be required to register by creating a username and password to access the application portal. Once you log in, you must complete all the information before submitting the application. Applications can be saved and completed at a later time.

2. Call to request a paper application. Call 1 (800) 659-2955 to request a paper application. The application will be sent in the mail. Once you receive it, you must complete all the information and send it back. The Customer Service Call Center is open from 8 a.m. to 8 p.m. EST, seven days a week.

What information or documents do I need to apply?

Lampton said the application doesn’t ask for a lot of data. You’ll only be required to fill out general information about your business. “It’ll be like filling out a credit card application,” Lampton said.

Usually, businesses are required to upload a copy of their tax return or submit a form that allows the SBA to receive a business tax return through the IRS, but Lampton said the SBA is trying to simplify its processes to get businesses into the system quicker.

How long does it take for a loan to get approved or denied?

Once your application is received by the SBA’s processing and disbursement center, it will be assigned to an SBA loan officer who will contact your business for more information – if more information is required. Lampton recommends gathering important business documents should the loan officer request something.

After working with your officer, Lampton said it typically takes 14 to 21 days to get a decision regarding the loan.

Businesses can check their application status online at www.disasterloan.sba.gov or by calling 1 (800) 659-2955 and selecting option 2.

How much money can my business get?

Lampton said the amount granted is based on a business’s projected losses. Your loan officer will work with you to calculate a loan amount. You’ll likely have to compare your sales and revenue streams from the previous year, and project anticipated losses for this year because of COVID-19. Your loan officer may ask to see financial statements, so be prepared to deliver.

How and when would my business receive financial assistance?

If you’re approved, your loan officer would draft the loan closing papers and mail them to you. Together, you’ll set a closing date, and you’ll sign the promissory note to repay your loan. The funds are generally distributed electronically into an account five days after the closing. However, business owners can request to receive the money other ways.

What are the loan conditions?

The interest rate is 3.75 percent for small businesses. The interest rate for non-profits is 2.75 percent. SBA offers loans with long-term repayments of up to 30 years to keep payments affordable. Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay.

What do I do if my business isn’t approved?

If your business isn’t approved for a loan, don’t get discouraged. Instead, explore other options. Lampton said many states have loan and grant programs for small businesses. Check with your state to determine if there are other available programs.

Additional Tips

- Act now. “Right now, it’s key to get your application in,” Lampton said. “The sooner it gets in, the sooner you can get a decision. We want to try to get the money in your hands as quickly as possible. The process begins with you. Go online or call today to complete your application.”

- Be patient. “Because of the virus, a lot of people are at home and have time to complete [and submit] applications,” Lampton said. “The volume of applications we’ve received has picked up tremendously. If you run into any issues, it’s because of the level of traffic we’re experiencing. I encourage businesses not to give up, but to try again in the late evening.”

- Get assistance. “Call the SBA Customer Service Center (1-800-659-2955) to get assistance anytime during the normal business hours,” Lampton said. “If you’re completing your application and have a question, we have people set aside specifically to respond to any questions regarding the loan process.”

- Visit the SBA website for loan information and other small business guidance.

The ATA understands it’s a difficult time for everyone, but we’re here to help. Visit the ATA’s webpage dedicated to COVID-19 for more information.

Still have questions? The Outdoor Industry Association is hosting a Webinar on March 31, 2020, at noon CST featuring Burl Kelton of the U.S. Small Business Administration. Sign up for the webinar here.